Say What You Want to Say

I was just listening to John Mayer’s song Say, and the words resonated very strongly with me, especially the last couple of verses…

Have no fear for giving in

Have no fear for giving over

You’d better know that in the end

It’s better to say too much

Than never to say what you need to say again

Even if your hands are shaking

And your faith is broken

Even as the eyes are closing

Do it with a heart wide open (a wide heart)

Say what you need to say

After listening and then reading these words, I began to think about how some women continually hold back from saying what they need to say and then wonder why they are living an unfulfilled life.

I thought it’s time for change, then looked at the picture on the wall in front of me (above) and went YES ‘Dragonflies symbolise change and change in the perspective of self-realisation.”

Our Lack of Voice in the Workplace

A constructive voice, when utilised effectively, will allow you to be recognised, rewarded and promoted in all aspects of your life. There truly is only one main reason why men are paid more than women and that is because they ask for more money.

They ask for it, it’s that simple.

Some women work very hard day after day thinking, “My boss will notice how great I am, always here on time, never sick, very efficient, so he will pay me what I’m worth.”

Wow, how great would that be? Unfortunately, that is very rarely the case. Don’t rely on merit or hard work to be the basis for pay rises.

We have to constantly show and inform our bosses how great we are and what an asset we are to the company. Men are constantly in their boss’ face, telling them how the company could not survive without them, how much money they have saved the company and why they should be paid more money and promoted.

Let’s be honest ladies, how many times have you had a boss who knew less than you, worked less efficiently than you and you wondered why the hell he had the job instead of you, especially seeing you were the reason he shined?

Share your money saving ideas.

A lot of women hold back on sharing money-saving ideas as they feel they may be perceived as a trouble maker in the eyes of their employer. This is classic survival mode. What we are really thinking is “I need this job to survive,” and we remain merely surviving instead of thriving.

Now don’t get me wrong, I totally understand the thinking, “I can’t rock the boat, I have a mortgage to pay. I can’t survive without this job as I am living week to week.”

Also, that way of thinking is “topsy-turvy thinking.” It comes from a lack of self worth and self-esteem and is the reason we get trapped in a ground-hog day life, so to speak.

By actually sharing our ideas with our bosses in a constructive, professional manner, they will more likely notice us, see us as a thought-leader, recognise that we care about the organisation, be thankful that they can save some money and, more importantly, may even promote us, especially if we continue to come up with these ideas.

Start thinking and working from this perspective. Put your hand up for projects even if you feel that you may not have all the skills required for the tasks. You will learn quickly and grow exponentially when you are given the chance. And guess what? No one expects you to know it all. You just have to know where to look for answers and the internet is a valuable resource.

Richard Branson, founder of Virgin Group, is the first to admit that he is never the smartest person in any company meeting. He hires people to fill the gaps in his knowledge. A favourite quote of Richard’s (and there are many) is: “If someone offers you an amazing opportunity and you’re not sure you can do it, say yes – then learn how to do it later.”

How much is your lack of voice in the workplace actually costing you (now and at retirement)?

In my book A Journey to Becoming Your Own Best Friend I shared this exercise and it’s still very relevant…

In Australia, the statistics as of May 2014 show that of all taxpayers, only 2% of women ages 18 to 49 earn more than $100,000.

Unbelievable isn’t it?

I was amazed when I read this.

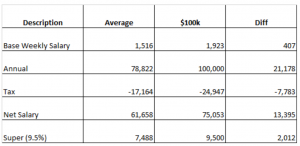

The same data shows that the average weekly earnings are $1,516 per week or $78,822 annually. With superannuation at 9.5%, you’re annually adding $7,488 to your super fund (retirement fund).

So let’s do a little exercise now (I may be a Recovering Accountant, though I still love any excuse to use Excel). Take a look at what you could potentially have at retirement as an extra investment just by increasing your salary to $100,000, an easy salary to reach once you are part of the management team—and there is no reason you can’t be a manager, remember “If you can think it, you can do it.”

This table shows the yearly difference from the average weekly salary:

Now, if you invested the extra $13,395 on a monthly basis ($1,116 each month) over a 20-year period at a percentage yield of 10%, you would have $847,456 at retirement.

Don’t you just love compound interest!!

Even if the yield was 5%, you would have an extra $458,714.

Ok, I know that you may not invest the total $13,395 every year, but why not? If you have been managing without the extra income, why change?

I am a great believer in the saying: “If all you do is save for a rainy day that is all you will get.” I see this exercise as something completely different, as this is extra money you will be earning only because you have chosen to start to utilise your voice, to ask for what is rightfully yours.

Personally, I wish I had followed this advice when I had my CFO role. It totally makes sense, and just goes to show how dis-eased I was, not thinking clearly at all!!

Just imagine what your retirement lifestyle would be like with an extra $847,456. Just think how much younger you’d be when you retire, how much fitter you’ll be so you’re able to travel and truly enjoy your golden years.

And the scenario above does not even account for any pay increases you would get over the 20 years or take into account your super fund. The extra superannuation of $2,012 per year alone will equate to an extra $128,000 at retirement if the yield is 10% (most super funds are averaging a lot more than 10%).

Say what you want to say

So the next time you decide to sit back, whilst working your “arse off” waiting for your boss to notice you and pay you what you’re worth, think about this little exercise. You really are not doing “your best friend” or her retirement plans any favours by not utilising your voice.

It is everyone’s right to have a joyous, harmonious and prosperous life so go and get it.

Stop playing small.

You know in your heart that you desire it because you deserve it. And your voice is the key.

As John Mayer so eloquently sings:

Do it with a heart wide open (a wide heart)

Say what you need to say!!

Not sure where to start?

Then check out the many resources on this website.

Until next time…..

Be well and remember to make each day meaningful, memorable and magical………..and never, ever, ever stop dancing!

With Love & Gratitude

Karen Chaston.